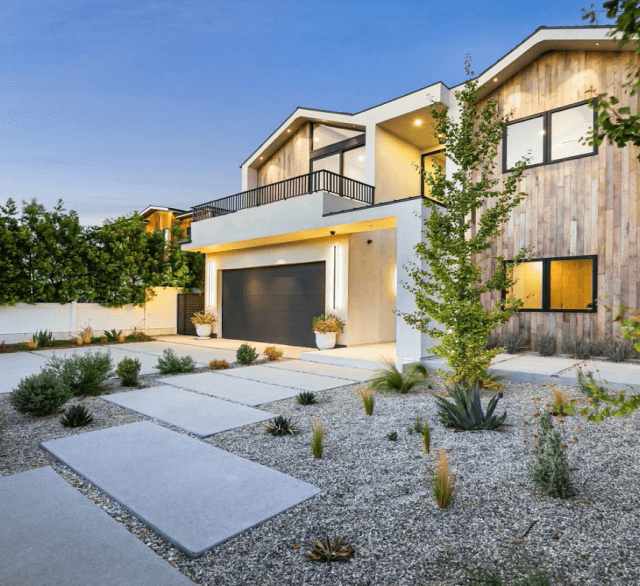

Fast, Flexible Financing for Real Estate Investors Across San Diego

For experienced real estate investors in San Diego, the journey to portfolio growth shouldn’t be stalled by tax returns or personal income documents. The Southern California rental market is chronically supply-constrained, driving high rents, low vacancy, and exceptional long-term appreciation. You need a financial partner who focuses on your asset’s potential. Archwest Capital provides agile, in-house Debt Service Coverage Ratio (DSCR) loans designed specifically for investors scaling their San Diego rental portfolio.

From high-yield short-term rentals (STRs) in Pacific Beach and ADU-enhanced SFRs in Clairemont to multi-family acquisitions in North Park and the rapidly expanding South Bay areas, our streamlined financing and expert process empower you to acquire and refinance investment properties with speed and confidence.

DSCR Rental Loan

Term

30 Years

Loan Amount

$75K to $3.5M

LTV

Up to 80%

LTV Cashout

Up to 75%

Property Types

Non-Owner Occupied

SFR, Condo, Townhome, 2–4 Plex

Multifamily Up to 9 Units

Short-Term Rentals Okay

Power Your Next Portfolio Expansion with Cash Flow-Based Financing

Your rental properties are investments, and they should be financed like one. Our DSCR Rental Loan is built for real estate investors ready to secure long-term financing based on the property’s ability to generate income, not your personal debt-to-income ratio. With competitive terms, flexible qualification, and a fast path to closing, we deliver the certainty and resources you need to scale your business.

Whether you are acquiring a new single-family rental, refinancing a portfolio of 5-9 unit buildings, or securing a loan for a short-term rental in a high-demand area, our DSCR Loan provides the capital structure and confidence to grow your cash flow in the dynamic San Diego market.

The Lender Built for Rental Property Investors

At Archwest Capital, we understand that portfolio success hinges on rapid, reliable financing that bypasses traditional bank hurdles. We are not a traditional bank; our lending approach is built on a deep understanding of investment real estate and the need for a lender who underwrites based on the asset. Our DSCR loan program is crafted for efficiency and flexibility, ensuring you have the capital you need precisely when a great deal closes.

Free 30-Day Rate Lock

Up to $3.5 Million Loan

No Max Per Unit Rent

Min DSCR as Low as .75

Your San Diego Investment Partner: Local Market Insights

Beyond providing capital, Archwest Capital is a partner with unparalleled local market knowledge. Our team closely monitors the trends and opportunities unique to the San Diego area, empowering you to make data-driven investment decisions.

Specializing in San Diego's DSCR Rental Markets

We specialize in financing investment properties in the neighborhoods where San Diego’s rental investors are finding the greatest cash flow and stability for their long-term portfolios.

North Park & Normal Heights: These central, urban-infill neighborhoods are highly competitive for acquiring multi-unit properties (duplexes/triplexes). We quickly underwrite deals based on market rents, helping you secure fast financing to acquire cash-flowing assets in these popular rental zones.

Pacific Beach & Clairemont: Prime areas for short-term rentals (STRs) and ADU-enhanced single-family rentals. We fund these high-demand properties by assessing projected rental income, maximizing your eligibility in high-turnover, high-yield zones.

Coastal & Inland Enclaves: Our DSCR solutions cover all opportunities from luxury coastal rentals in La Jolla to stable, affordable SFRs in El Cajon and Chula Vista. We provide the flexible capital you need to scale your portfolio across the entire San Diego County MSA.

Benefits in the San Diego Market

| Benefits | Why It Matters Here |

|---|---|

| Quick Pre-Qualification | Move fast in a competitive market |

| No W2s or Tax Returns Needed | Ideal for full time and part time investors |

| Flexible Terms & Rate | Customize to match your investment strategy |

| Great for BRRRR & Long-Term Rentals | Use for rehab-to-rent or cash-out refinance |

| Repeatable for Portfolio Growth | Use again and again for new acquisitions |

What Our Partners Say

I’ve worked with Archwest Capital on both a bridge loan and a full construction loan, and their team, led by Danny, consistently goes above and beyond. As a developer in the valley, having a reliable lending partner is crucial—and Archwest delivers with outstanding service, accessibility, and a proactive mindset. Danny once took my call on a Saturday and had everything I needed in my inbox by Monday, showing his genuine commitment to clients. Most recently, they helped us close a complex deal with overseas owners, coordinating late-night calls, Zooms, and emails to get it done smoothly. Their dedication and flexibility have made a lasting impression.

Kevin H.

Developer

If getting a loan was an Olympic sport, Justin would take home the gold—while answering emails mid-victory lap. He’s the kind of lender who actually picks up the phone, responds faster than our morning coffee kicks in, and somehow makes the whole process dare I say enjoyable.

Need a lender who gets ish done? Justin’s your guy. Need one who keeps things smooth and stress-free? Still Justin. Need one who can time travel to close deals at warp speed? I’m pretty sure he’s working on that too.

Bottom line: If you’re looking for a lender who’s a pleasure to work with and makes financing feel effortless, call Justin. Just don’t ask him to slow down—he physically can’t.

Matt S.

Real Estate Investor

I’ve had the pleasure of working with Jennifer Lightbody & Jennifer Tran on numerous transactions and the experience was nothing short of exceptional. They are both incredibly professional, responsive and knowledgeable. They are always ahead of the game during the funding process, and always make sure the loan gets funded as smoothly as possible. They are both a DREAM to work with. I cant recommend them both enough!

Natalie N.

Real Estate Investor

I used Archwest to help fund a large transaction involving multiple new construction homes. It was not a typical project, but we were able to close on time.

I’d highly recommend collaborating with Archwest on any real estate projects.

Jonathan C.

Real Estate Investor

Archwest has the most efficient lending team I have ever worked with.

They work quickly and clearly to make sure their customers are fully satisfied, all while being friendly and approachable. They make what seems like the impossible, possible.

My team and I look forward to working with them on many more deals to come.

Emilienne F.

Real Estate Investor

Archwest is the best lender for San Diego's rental investors who are ready to scale. We help clients execute with speed and maximize cash flow.

How It Works

Debt Service Coverage Ratio

We measure the ratio of your rental income to your debt obligations. For a DSCR of 1.20, rental income must comfortably cover your loan payments (120% of debt service), easing stress on cash flow.

Income Analysis

We use scheduled rents (vs. owner occupancy) and market comparables to calculate realistic net operating income (NOI).

Loan Structure & Underwriting

We underwrite based on NOI, not personal income. This lets investors qualify based on property performance—ideal for investors with strong rental assets but limited W-2 income.

Funding & Closing

Upon DSCR approval, we offer flexible terms and rates. Once accepted, we coordinate title, appraisal, and closing—usually 2-3 weeks.

Frequently Asked Questions About

DSCR Loans in San Diego

What is a DSCR loan and how does it work?

A DSCR loan, or Debt Service Coverage Ratio loan, is a type of financing for investment properties that qualifies the borrower based on the property’s rental income relative to its debt obligations. The formula is: DSCR = Gross Monthly Rent / Monthly PITIA (Principal, Interest, Taxes, Insurance, and HOA dues). If the ratio is 1.0 or higher, the property’s income covers the debt.

What is the typical DSCR requirement for a rental property?

While Archwest Capital can finance loans with a DSCR as low as 0.75x, most properties that cash flow well will have a ratio of 1.0x or higher. A higher DSCR typically leads to more favorable loan terms and a lower interest rate.

Do I need to provide tax returns or personal income for a DSCR loan?

No. The primary benefit of a DSCR loan is that qualification is based on the cash flow of the investment property, not the borrower’s personal income, employment history, or tax returns. This makes it ideal for self-employed individuals and investors with complex financial structures.

Can I use a DSCR loan for a multifamily property?

Yes. Archwest Capital provides DSCR financing for various investment property types, including single-family residences (SFRs), Condo, Townhome, 2–4 Plex, multifamily up to 9 units, and short-term rentals.

How does a DSCR loan differ from a conventional mortgage?

Conventional mortgages require extensive personal income documentation (W-2s, tax returns) and focus on the borrower’s debt-to-income (DTI) ratio. A DSCR loan requires no personal income proof, focusing instead on the property’s DSCR. This allows investors to scale their portfolio more quickly and easily.

Ready to Grow your Portfolio in San Diego?

Start your next project with a lender who understands your business.

Nationwide Lender with Local Expertise

County: San Diego

Cities: San Diego, Chula Vista, Oceanside, Escondido, Carlsbad, El Cajon, Vista, San Marcos, Encinitas, National City, La Mesa, Santee, Poway, Solana Beach

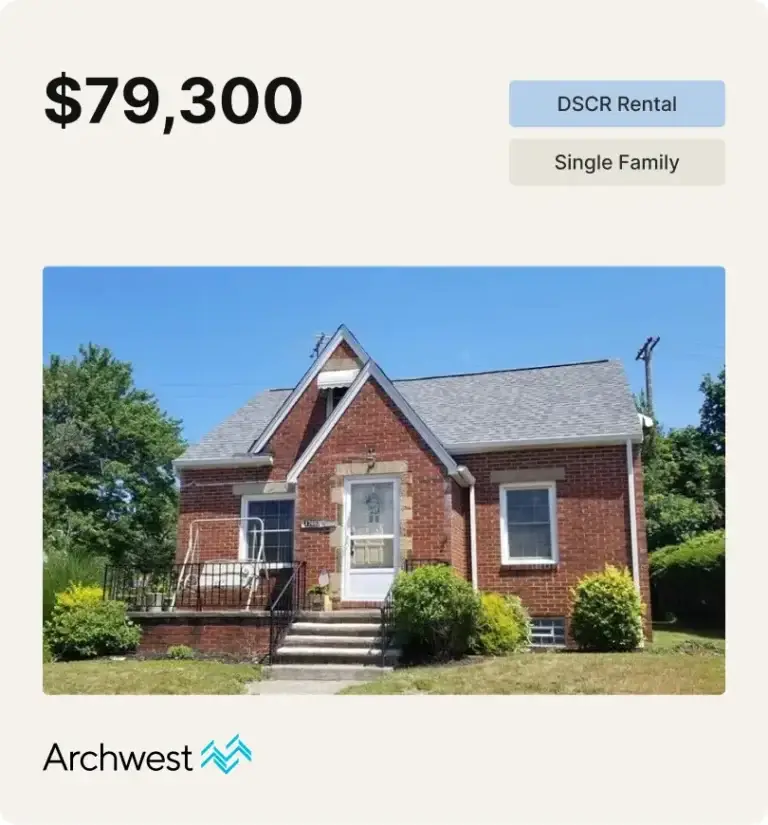

Recently Funded

Ready to Grow in San Diego?

From Pacific Beach and North Park to La Jolla and Chula Vista, San Diego delivers premium rents, low vacancy, and exceptional long-term appreciation for investors focused on wealth building. Archwest gives you the financing edge to scale your portfolio across the entire MSA.