Fast, Flexible Financing for Property Flippers in Chicago

For experienced real estate investors, time is your most valuable asset. The real estate market in Chicago is highly competitive, characterized by intense buyer demand and rapid turnover in desirable neighborhoods. You need a financial partner who can move faster than the city’s pace. Archwest Capital provides agile, in-house fix and flip loans designed specifically for the unique demands of the Chicago investment landscape, where local expertise and speed are everything.

From classic Greystone restorations in Logan Square and vintage condo conversions in Lincoln Park to multi-unit value-adds in Bronzeville and high-end modernizations in the West Loop, our tailored financing and streamlined process empower you to rehab with confidence and speed.

Fix and Flip Loan

Term

6 to 30 Months

Loan Amount

$150K to $5M+

LTC

Up to 93.5%

Cost Breakdown

& 100% of Rehab

Property Types

Non-Owner Occupied

SFR, Condo, Townhome, 2–4 Plex

Multifamily Up to 9 Units

ADU Conversions Okay

Power Your Next Project with Speed and Certainty

Fix-and-flip projects demand speed, flexibility, and reliable capital. Our Fix & Flip Loan is built for experienced real estate investors ready to turn distressed properties or outdated homes into profitable residential assets. With competitive terms, strong leverage, and financing tailored to a wide range of property types, we deliver the certainty and resources you need to bring your vision to life.

From gut renovations and light remodels to historic home modernizations and portfolio flips, our Fix & Flip Loan provides the capital structure and confidence to take your project from acquisition to resale, on time and on budget.

The Archwest Difference: A Lender Built for Fix & Flip Investors

At Archwest Capital, we understand that your project’s success hinges on rapid, reliable financing. We are not a traditional bank; our lending approach is built on a deep understanding of investment real estate and the need for a lender who understands your business. Our loan programs are crafted for efficiency and flexibility, ensuring you have the capital you need precisely when you need it.

Term Sheet Within 24 Hours

Closings in Under 7 Days

Interest on Drawn Amounts Only

100% of Rehab Funding Available

Your Chicago Investment Partner: Local Market Insights

Beyond providing capital, Archwest Capital is a partner with unparalleled local market knowledge. Our team closely monitors the trends and opportunities unique to Chicagoland, empowering you to make data-driven investment decisions.

Specializing in Chicago's High-Profit Fix & Flip Markets

We specialize in financing projects in the neighborhoods where Chicago’s real estate investors are finding the greatest resale success.

Lincoln Park & West Loop: As hyper-competitive areas for high-end buyers, these markets demand a lender who prioritizes speed for quick acquisitions. Our agile process ensures you secure financing quickly to win deals on luxury condo and single-family home rehabilitations.

Logan Square & Pilsen: These neighborhoods are major hotspots for vintage restoration and multi-unit conversions. We have the expertise to accurately value and fund projects that maximize After Repair Value (ARV), turning dated properties into high-margin flips.

The South Side & Beyond: From acquiring distressed multi-flats in Bronzeville to modernizing single-family homes in desirable suburbs, our financing solutions are tailored to the wide range of fix and flip opportunities across the South Side and the entire Chicago Metropolitan Area.

Benefits in the Chicago Market

| Benefits | Why It Matters Here |

|---|---|

| Up to 90% LTC | Buy more with less out of pocket |

| 100% Rehab Financing | Complete your full scope without using your own cash |

| Fast Approvals | Close quickly in competitive neighborhoods |

| Ideal for Value Add Deals | Perfect for older Maryland homes with strong resale upside |

| Local Support | Maryland based insights to guide you deal-by-deal |

What Our Partners Say

I’ve worked with Archwest Capital on both a bridge loan and a full construction loan, and their team, led by Danny, consistently goes above and beyond. As a developer in the valley, having a reliable lending partner is crucial—and Archwest delivers with outstanding service, accessibility, and a proactive mindset. Danny once took my call on a Saturday and had everything I needed in my inbox by Monday, showing his genuine commitment to clients. Most recently, they helped us close a complex deal with overseas owners, coordinating late-night calls, Zooms, and emails to get it done smoothly. Their dedication and flexibility have made a lasting impression.

Kevin H.

Developer

If getting a loan was an Olympic sport, Justin would take home the gold—while answering emails mid-victory lap. He’s the kind of lender who actually picks up the phone, responds faster than our morning coffee kicks in, and somehow makes the whole process dare I say enjoyable.

Need a lender who gets ish done? Justin’s your guy. Need one who keeps things smooth and stress-free? Still Justin. Need one who can time travel to close deals at warp speed? I’m pretty sure he’s working on that too.

Bottom line: If you’re looking for a lender who’s a pleasure to work with and makes financing feel effortless, call Justin. Just don’t ask him to slow down—he physically can’t.

Matt S.

Real Estate Investor

I’ve had the pleasure of working with Jennifer Lightbody & Jennifer Tran on numerous transactions and the experience was nothing short of exceptional. They are both incredibly professional, responsive and knowledgeable. They are always ahead of the game during the funding process, and always make sure the loan gets funded as smoothly as possible. They are both a DREAM to work with. I cant recommend them both enough!

Natalie N.

Real Estate Investor

I used Archwest to help fund a large transaction involving multiple new construction homes. It was not a typical project, but we were able to close on time.

I’d highly recommend collaborating with Archwest on any real estate projects.

Jonathan C.

Real Estate Investor

Archwest has the most efficient lending team I have ever worked with.

They work quickly and clearly to make sure their customers are fully satisfied, all while being friendly and approachable. They make what seems like the impossible, possible.

My team and I look forward to working with them on many more deals to come.

Emilienne F.

Real Estate Investor

Archwest is the best lender to the best flippers. We help clients execute with speed and maximize returns.

How It Works

Apply Online

We assess your plans and track record to ensure a strong market fit.

Get Approved Fast

Detailed review of budget, scope, and exit strategy with appraisals based on completed value.

Close & Fund

Interest-only payments during construction; underwriting focused on project strength.

Renovate & Sell (or Refi)

Fix the property and exit through sale or transition into a DSCR rental loan.

Frequently Asked Questions About

Fix & Flip Loans in Chicago?

What is a fix & flip loan?

A fix-and-flip loan is a type of short-term financing used to purchase and renovate a residential property with the intention of reselling it for a profit. Unlike traditional mortgages, these loans are designed for investors and are structured to cover both the acquisition and the renovation costs.

What are the typical requirements for a fix & flip loan?

At Archwest Capital, we focus on the deal’s merit, not personal income. Our key requirements include a detailed project plan, a realistic renovation budget, and a proven track record of successful flips. While a minimum credit score is often a factor, our primary focus is on the deal’s viability and your ability to execute the project.

How does the loan draw process work?

The loan draw process is the way renovation funds are disbursed. Once the loan closes, a series of scheduled draws are made to pay for completed work and materials. This process is managed by your dedicated account manager who, after a quick inspection to verify completion, will disburse funds into your account to keep the project moving forward.

What is the typical loan term and interest rate?

Our fix-and-flip loan terms typically range from 6 to 30 months, with interest-only payments during the renovation period. We offer competitive rates tailored to your project. Interest payments are only on the funds you have drawn, not the entire loan amount.

How do your loans differ from a traditional bank loan?

Traditional bank loans often require extensive personal income documentation, a low debt-to-income ratio, and a lengthy approval process. Archwest Capital focuses on the investment property itself and your experience as a flipper, providing a faster, more flexible, and more efficient path to funding your business-purpose project.

Ready to Build in Chicago?

Start your next project with a lender who understands your business.

Nationwide Lender with Local Expertise

County: Cook, DuPage, Kane, Lake, Will, McHenry, Kendall, Grundy

City: Chicago, Naperville, Aurora, Joliet, Elgin, Waukegan, Evanston, Schaumburg, Skokie, Oak Park

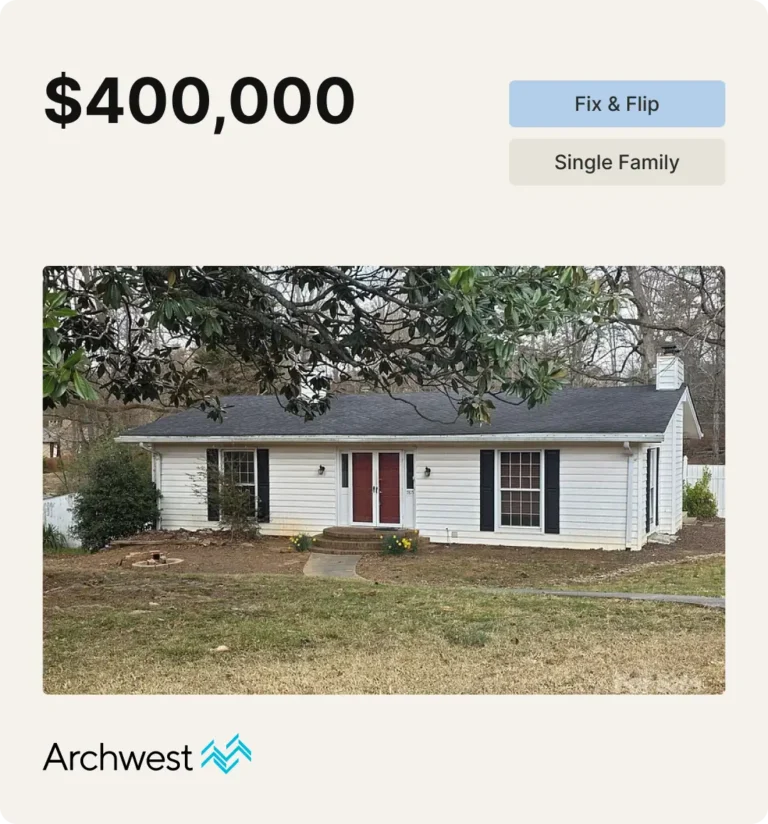

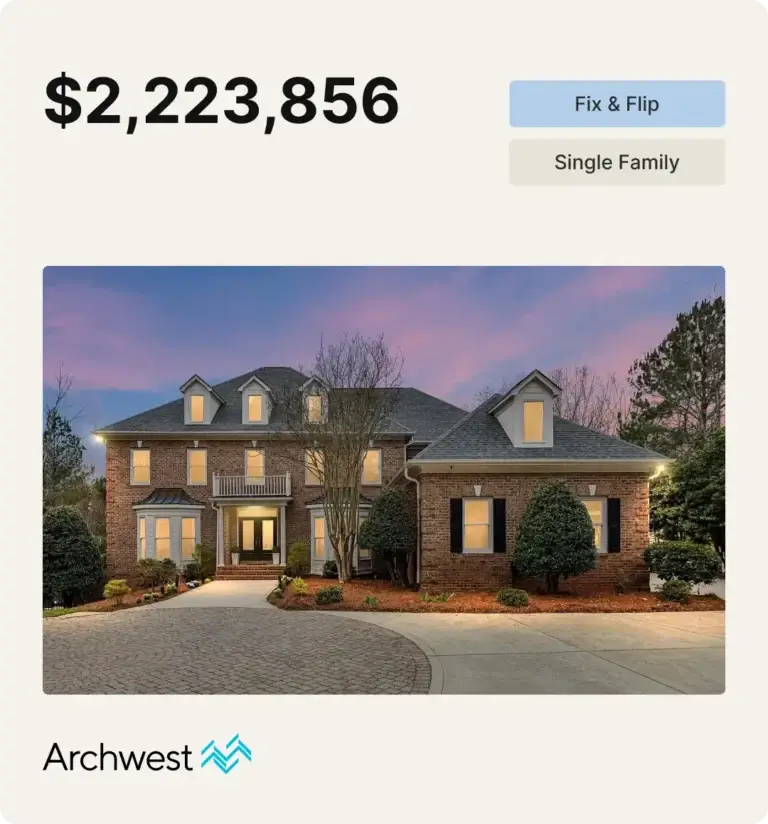

Recently Funded

Ready to Flip in Chicago?

From Lincoln Park to Englewood, Logan Square to Orland Park, the Chicago Metro offers high-profit, value-add opportunities for experienced investors who move fast. With Archwest, you’ll get funding that matches your hustle.