Orlando's Fix & Flip Lender for Experienced Investors

For experienced real estate investors in Orlando, time is your most valuable asset. The Central Florida real estate market is intensely competitive and offers significant profit potential (with property values seeing over 25% appreciation year-over-year in some areas). You need a financial partner who can move faster. Archwest Capital provides agile, in-house fix-and-flip loans designed specifically for the unique demands of the Orlando investment landscape, where acquisition speed and value-add renovation are the keys to profit.

From gut rehabs of mid-century homes in competitive markets like Winter Park and College Park to high-end modernizations and multi-unit conversions in high-growth corridors like South Semoran and Pine Castle, our tailored financing and streamlined process empower you to renovate with confidence and speed.

Fix and Flip Loan

Term

6 to 30 Months

Loan Amount

$150K to $5M+

LTC

Up to 93.5%

Cost Breakdown

& 100% of Rehab

Property Types

Non-Owner Occupied

SFR, Condo, Townhome, 2–4 Plex

Multifamily Up to 9 Units

ADU Conversions Okay

Power Your Next Project with Speed and Certainty

Fix-and-flip projects demand speed, flexibility, and reliable capital. Our Fix & Flip Loan is built for experienced real estate investors ready to turn distressed properties or outdated homes into profitable residential assets. With competitive terms, strong leverage, and financing tailored to a wide range of property types, we deliver the certainty and resources you need to bring your vision to life.

From gut renovations and light remodels to historic home modernizations and portfolio flips, our Fix & Flip Loan provides the capital structure and confidence to take your project from acquisition to resale, on time and on budget.

The Archwest Difference: A Lender Built for Fix & Flip Investors

At Archwest Capital, we understand that your project’s success hinges on rapid, reliable financing. We are not a traditional bank; our lending approach is built on a deep understanding of investment real estate and the need for a lender who understands your business. Our loan programs are crafted for efficiency and flexibility, ensuring you have the capital you need precisely when you need it.

Term Sheet Within 24 Hours

Closings in Under 7 Days

Interest on Drawn Amounts Only

100% of Rehab Funding Available

Your Orlando Investment Partner: Local Market Insights

Beyond providing capital, Archwest Capital is a partner with unparalleled local market knowledge. Our team closely monitors the renovation trends, the crucial 70% ARV rule, and the competition for limited inventory unique to the entire Orlando MSA. We understand which essential upgrades, like open floor plans and modern pool areas, yield the highest After Repair Value (ARV) in every submarket.

Specializing in Orlando's High-Profit Fix & Flip Markets

We specialize in financing projects in the neighborhoods where Orlando’s real estate investors are finding the greatest resale success.

College Park & Winter Park: These desirable, affluent areas are highly competitive for acquiring dated homes that require complete structural and cosmetic modernization. Our agile process ensures you secure fast capital to win deals and execute high-end restorations for premium resale prices.

South Semoran & Pine Castle: These are major hotspots for volume rehabilitations of single-family homes and duplexes. We have the expertise to accurately value and fund projects that capitalize on deep discounts and maximize profit margins for workforce housing buyers.

Near Attractions (Kissimmee): Targeting older housing stock near attractions that can be renovated and resold as highly profitable, STR-ready vacation homes, capturing the top end of the resale market.

Benefits in the Orlando Market

| Benefits | Why It Matters Here |

|---|---|

| Up to 90% LTC | Buy more with less out of pocket |

| 100% Rehab Financing | Complete your full scope without using your own cash |

| Fast Approvals | Close quickly in competitive neighborhoods |

| Ideal for Value Add Deals | Perfect for older homes with strong resale upside |

| Local Support | Insights to guide you deal-by-deal |

What Our Partners Say

I’ve worked with Archwest Capital on both a bridge loan and a full construction loan, and their team, led by Danny, consistently goes above and beyond. As a developer in the valley, having a reliable lending partner is crucial—and Archwest delivers with outstanding service, accessibility, and a proactive mindset. Danny once took my call on a Saturday and had everything I needed in my inbox by Monday, showing his genuine commitment to clients. Most recently, they helped us close a complex deal with overseas owners, coordinating late-night calls, Zooms, and emails to get it done smoothly. Their dedication and flexibility have made a lasting impression.

Kevin H.

Developer

If getting a loan was an Olympic sport, Justin would take home the gold—while answering emails mid-victory lap. He’s the kind of lender who actually picks up the phone, responds faster than our morning coffee kicks in, and somehow makes the whole process dare I say enjoyable.

Need a lender who gets ish done? Justin’s your guy. Need one who keeps things smooth and stress-free? Still Justin. Need one who can time travel to close deals at warp speed? I’m pretty sure he’s working on that too.

Bottom line: If you’re looking for a lender who’s a pleasure to work with and makes financing feel effortless, call Justin. Just don’t ask him to slow down—he physically can’t.

Matt S.

Real Estate Investor

I’ve had the pleasure of working with Jennifer Lightbody & Jennifer Tran on numerous transactions and the experience was nothing short of exceptional. They are both incredibly professional, responsive and knowledgeable. They are always ahead of the game during the funding process, and always make sure the loan gets funded as smoothly as possible. They are both a DREAM to work with. I cant recommend them both enough!

Natalie N.

Real Estate Investor

I used Archwest to help fund a large transaction involving multiple new construction homes. It was not a typical project, but we were able to close on time.

I’d highly recommend collaborating with Archwest on any real estate projects.

Jonathan C.

Real Estate Investor

Archwest has the most efficient lending team I have ever worked with.

They work quickly and clearly to make sure their customers are fully satisfied, all while being friendly and approachable. They make what seems like the impossible, possible.

My team and I look forward to working with them on many more deals to come.

Emilienne F.

Real Estate Investor

Archwest is the best lender to the best flippers. We help clients execute with speed and maximize returns.

How It Works

Apply Online

We assess your plans and track record to ensure a strong market fit.

Get Approved Fast

Detailed review of budget, scope, and exit strategy with appraisals based on completed value.

Close & Fund

Interest-only payments during construction; underwriting focused on project strength.

Renovate & Sell (or Refi)

Fix the property and exit through sale or transition into a DSCR rental loan.

Frequently Asked Questions About

Fix & Flip Loans in Orlando

What is a fix & flip loan?

A fix-and-flip loan is a type of short-term financing used to purchase and renovate a residential property with the intention of reselling it for a profit. Unlike traditional mortgages, these loans are designed for investors and are structured to cover both the acquisition and the renovation costs.

What are the typical requirements for a fix & flip loan?

At Archwest Capital, we focus on the deal’s merit, not personal income. Our key requirements include a detailed project plan, a realistic renovation budget, and a proven track record of successful flips. While a minimum credit score is often a factor, our primary focus is on the deal’s viability and your ability to execute the project.

How does the loan draw process work?

The loan draw process is the way renovation funds are disbursed. Once the loan closes, a series of scheduled draws are made to pay for completed work and materials. This process is managed by your dedicated account manager who, after a quick inspection to verify completion, will disburse funds into your account to keep the project moving forward.

What is the typical loan term and interest rate?

Our fix-and-flip loan terms typically range from 6 to 30 months, with interest-only payments during the renovation period. We offer competitive rates tailored to your project. Interest payments are only on the funds you have drawn, not the entire loan amount.

How do your loans differ from a traditional bank loan?

Traditional bank loans often require extensive personal income documentation, a low debt-to-income ratio, and a lengthy approval process. Archwest Capital focuses on the investment property itself and your experience as a flipper, providing a faster, more flexible, and more efficient path to funding your business-purpose project.

Ready to Build in Orlando?

Start your next project with a lender who understands your business.

Nationwide Lender with Local Expertise

County: Lake, Orange, Osceola, Seminole

City: Orlando, Kissimmee, Sanford, Winter Park, Altamonte Springs, Ocoee, Winter Garden, Oviedo, Clermont, Apopka, Casselberry, Winter Springs, Lake Mary, Windermere, Saint Cloud, Longwood, Maitland, Pine Hills, Ocoee, Apopka

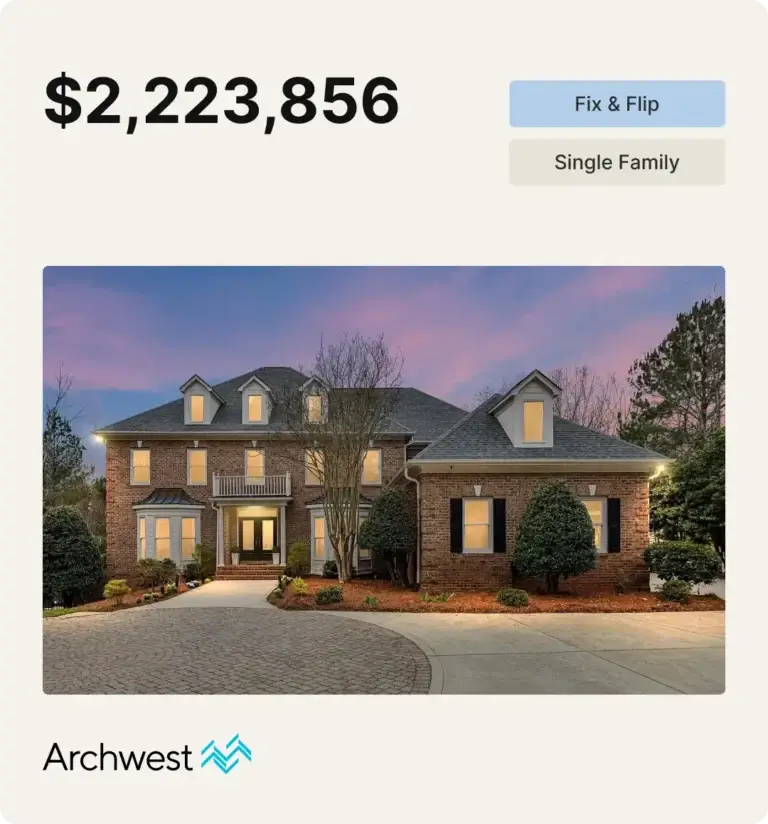

Recently Funded

Ready to Flip in Orlando?

From Winter Park to South Semoran, College Park to Pine Castle, the Orlando Metro offers high-demand, value-add opportunities with exceptional profit potential. Archwest delivers the funding you need to acquire, renovate, and sell fast across the entire MSA.